Efficient risk management for better business outcomes and customer stickiness with AI

Standardize risk assessments, reduce claim frequency, and increase policyholder engagement

AI to help your team consistently and accurately evaluate risks, improving profitability, client stickiness and market competitiveness

Standardize risk assessments, ensuring data accuracy and consistency

Standardize risk assessments, ensuring data accuracy and consistency

- Standardize risk assessments with AI-driven analysis for quicker, and more accurate issue identification

- Achieve consistent and validated risk assessments across your team members, eliminating experience or knowledge gaps

- Utilize regulatory standards, internal incident history, and loss data to highlight risks and ensure data accuracy

Identify and mitigate risks proactively, reducing accidents and violations

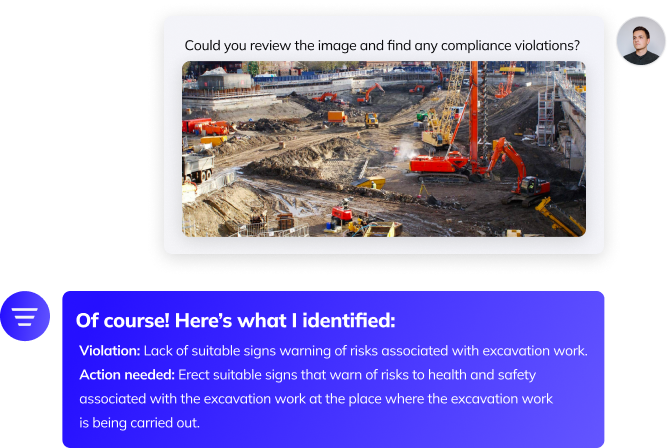

- Instantly analyze images or videos from onsite observations to identify risks and compliance gaps

- Spend 50% of the time less on risk identification, boosting the productivity of your team members

- Empower policyholders with actionable insights to mitigate risks before they lead to costly claims

Identify and mitigate risks proactively, reducing accidents and violations

Provide your clients with tailored, actionable recommendations

Provide your clients with tailored, actionable recommendations

- Generate easy-to-understand risk reports with proactive risk mitigation steps that meet the needs of policyholders

- Use policyholders’ specific safety, compliance, and regulatory standards to identify and mitigate their unique risks

- Enhance policyholder retention by keeping them engaged and providing the support they need to mitigate risks

Use cases

Automated Risk Report Generation

Scenario: A risk consultant is tasked with delivering a detailed compliance report for a client whose site is subjected to various regulatory requirements.

Challenge: The manual process of collecting, analyzing, and synthesizing risk data from different sites is time-consuming and prone to human error.

Solution: The SoterAI platform automates the entire risk report generation by analyzing and integrating images & videos from the site, OSHA regulations, and state-specific compliance standards.

Outcome: The time spent on reporting is cut by at least 50%, allowing the consultant to serve more clients and provide higher-quality insights.

Standardized Risk Identification Across Teams

Scenario: A risk consulting firm has multiple consultants working on various client projects, but inconsistency in risk identification has led to several discrepancies across reports.

Challenge: Consultants have varying levels of expertise, leading to inconsistent risk identification and management practices.

Solution: SoterAI standardizes the risk identification process through AI-driven assessment tools, ensuring uniformity across all consultants and projects.

Outcome: Clients receive uniform reports regardless of which consultant handles the project, improving trust and reducing errors.

Managing Compliance for a Client Site Regulated by Multiple Agencies

Scenario: A risk consultant is working with, e.g., a manufacturing client whose operations are regulated by multiple agencies like OSHA, EPA, and local state bodies. Keeping track of overlapping regulations is time-consuming and error-prone, making it difficult to ensure full compliance and timely reporting.

Challenge: Ensuring complete compliance with the varying regulations is burdensome, making it difficult to deliver comprehensive, accurate reports in a timely manner. Missing a requirement from any one agency could expose the client to fines, legal action, or operational shutdowns.

Solution: SoterAI automates the process of tracking and managing compliance across multiple regulatory frameworks by integrating real-time updates from each governing body and cross-referencing them with the client’s operational data.

Outcome: Automated regulatory cross-referencing ensures complete and consistent compliance, reducing the risk of missed regulations.

Data-Driven Insights for Faster Risk Mitigation

Scenario: A consultant is working with a client who struggles to prioritize which risks to address first.

Challenge: The client’s risk mitigation efforts are delayed because they lack clear, actionable insights to identify and prioritize risks.

Solution: SoterAI provides industry-proven risk prioritization (e.g. by analyzing a potential cost of a violation), giving the consultant clear insights into which risks are most critical and what actions are required.

Outcome: The client addresses the most critical risks first, reducing the likelihood of accidents and violations.

Standardizing Risk Assessments Across Multiple Clients

Scenario: An insurance carrier works with numerous external risk consultants, each providing varying levels of detail and quality in their assessments.

Challenge: This inconsistency makes it challenging for underwriters to accurately evaluate risk, often leading to mispriced policies and increased exposure to claims.

Solution: SoterAI standardizes the risk assessment process using AI, ensuring that data from different consultants is consistent, comprehensive, and validated against regulatory and industry standards.

Outcome: Standardized and validated data allows underwriters to make more accurate pricing decisions while reducing the risk of underpricing and unexpected claims.

Improving Engagement with Policyholders for Risk Mitigation

Scenario: A carrier struggles to get policyholders to engage in risk mitigation efforts.

Challenge: Many policyholders either underestimate the value of risk management or find the process complex and costly.

Solution: SoterAI provides policyholders with clear, easy-to-understand risk assessments and mitigation steps, increasing engagement by simplifying the process and demonstrating the potential financial benefits of proactive risk management.

Outcome: Policyholders are more likely to engage with risk mitigation when the process is simplified and the financial benefits are clear.