Soter Insurance: SoterAI for Your Virtual Loss Control Capability

Expand your loss control reach, strengthen underwriting confidence, and deliver more value to insureds — all without adding headcount, with Soter Insurance, a leading provider in virtual loss control solutions.

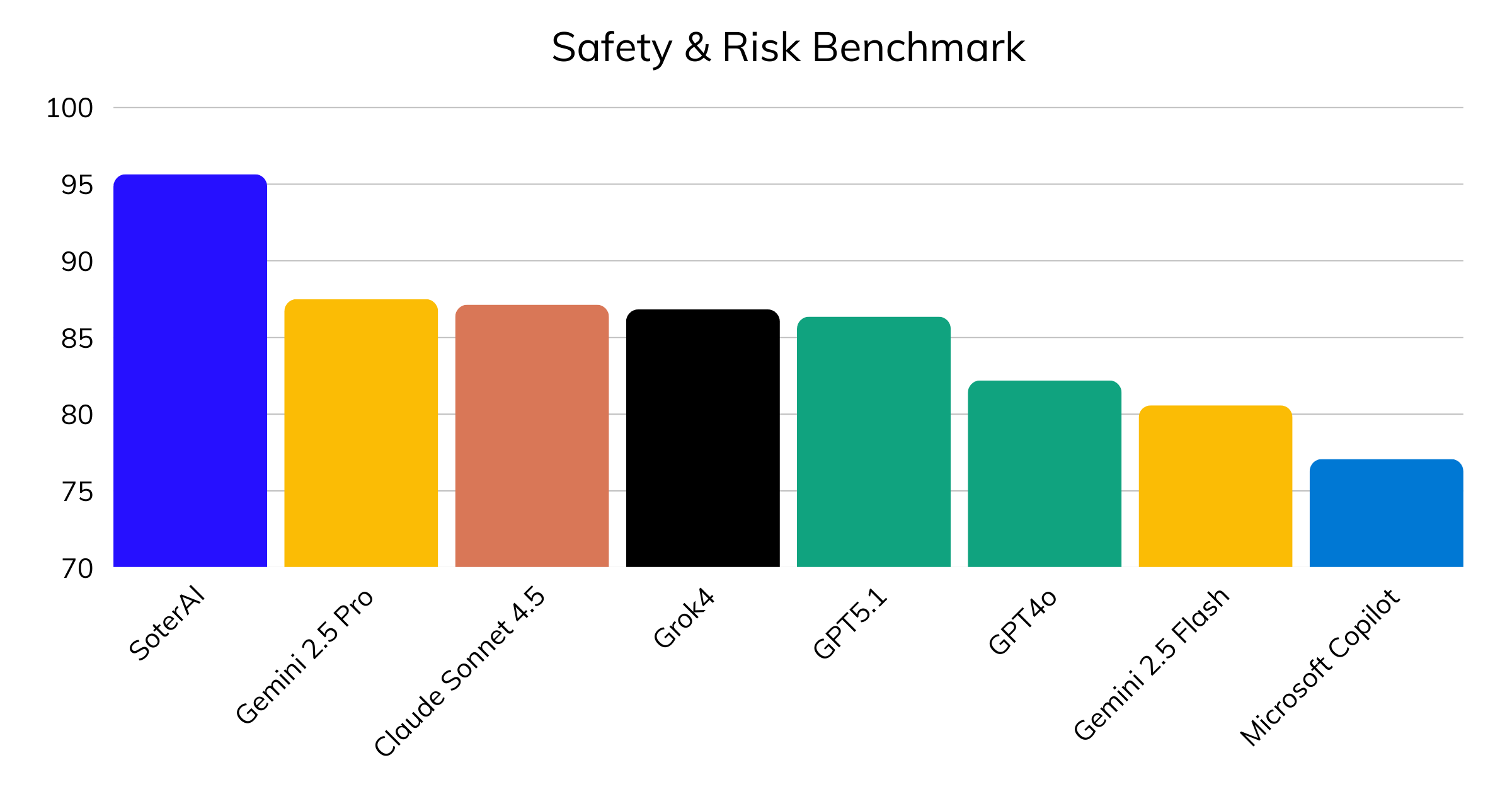

SAFE-Bench: Safety & Risk Benchmark Study

Discover how SoterAI achieves 95.64% accuracy — 8-19 percentage points higher than leading AI models like GPT-4o, Claude, and Gemini. See the data behind our specialized safety-critical AI system.

The Challenge

Rising claim costs and loss frequency squeeze margins

Traditional loss control only reaches large accounts (too costly for SMBs), creating a significant barrier for small and medium-sized businesses to access adequate soter insurance solutions.

Insureds demand more value-add at renewal

Lack of standardized data limits underwriting confidence

The Solution: Virtual Loss Control

A scalable, always-on loss control capability powered by AI

Conduct virtual audits in hours, not weeks

Analyze loss run data automatically for claim trends

Review safety policies against OSHA, ISO, and EU standards

Provide insureds with a suite of AI powered risk reduction tools. Connected devices enable real-time monitoring and early detection of safety issues.

Standardize reporting across accounts for underwriters and brokers. We offer customized solutions tailored to each client's unique risk profile.

Track improvements and prove ROI with EMOD and claim reduction insights

SoterAI leverages predictive analytics, IoT sensors, and risk management software to provide real-time insights and automation for effective insurance loss control solutions.

Key Benefits for Insurers

Expand loss control to every insured

Scale services beyond large accounts without adding staff by offering a range of loss control services now available to every insured.

Strengthen underwriting and risk management confidence

AI-driven insights from claims, policies, and inspections improve pricing and risk selection.

Differentiate at renewal

Provide insureds with a tangible, ongoing safety tool that sets you apart.

Improve loss ratios with measurable ROI

Fewer incidents and stronger controls directly lower EMODs and claims costs.

How It Works for Insurers

SoterAI supports insurance loss control by enabling insurers to identify sources of risk in property and operations, which is essential for effective risk management and reducing the likelihood of claims.

Connect data

- •Import claims, loss runs, safety policies, and inspection reports

- •Centralize insured data into a single, comparable view

Centralizing this data provides valuable resources for risk management and decision-making, enabling organizations to leverage comprehensive information and expert insights to identify exposures and implement effective loss prevention strategies.

Analyze

- •Pinpoint top risk drivers across accounts in minutes

- •Benchmark insureds against peers and portfolio averages

- •Flag accounts with rising claim severity or frequency before renewal

SoterAI leverages comprehensive loss control resources, including advanced data analytics and AI-driven solutions, to identify risk patterns and predict potential loss scenarios based on historical data.

Act & Prove

- •Deliver prioritized action plans insurers can share instantly with insureds

- •Generate standardized reports for brokers, underwriters, and clients

- •Track improvements that cut claims costs and lower e-mods / loss ratios

Automated information handling and verification in SoterAI improve the efficiency of insurance loss control processes, resulting in measurable cost savings and a stronger ROI for insurers and companies.

Physical Hazard Protection with SoterAI

Physical hazard protection is a vital component of any robust loss control program, and SoterAI brings advanced technology to the forefront of this effort.

Machine Learning Analysis

Powerful algorithms analyze survey data to identify and assess physical hazards throughout the workplace

Targeted Risk Mitigation

Provides company leaders with valuable insights and targeted strategies for effective hazard protection

Seamless Integration

Integrates with existing systems to implement loss control services without disrupting operations

SoterAI's seamless integration with existing systems allows organizations to efficiently implement loss control services and solutions without disrupting daily operations. The platform delivers actionable recommendations that enable companies to control costs, reduce the risk of accidents, and improve overall safety. By utilizing SoterAI's advanced technology, businesses can develop more effective loss control programs, leading to reduced premiums and stronger bottom-line results.

Proven Impact with SoterAI

See how leading insurers are transforming loss control operations

- Reduced custom safety meeting prep from ~5 hours to ~30 minutes

- 10% reduction in incident claims translates to several million dollars in savings

- Enhanced client satisfaction with clearer, faster, more impactful safety guidance

- Standardized data made it easier to present results to clients and underwriters

- Freed up staff time to focus on strategic risk management instead of admin

- Improved broker conversations at renewal by providing clear, consistent reporting

- Automated virtual audits completed in hours instead of days

- Enhanced risk assessment accuracy with AI-powered analysis

- Improved insured satisfaction with faster turnaround times

Traditional vs Virtual Loss Control

Traditional Loss Control

SoterAI Virtual Loss Control

Frequently Asked Questions

Insurance-specific questions about SoterAI

Ready to scale your loss control operations?

See how SoterAI helps insurers expand their reach, strengthen underwriting confidence, and deliver more value to insureds — all without adding headcount.

Book a personalized demo and discover how to conduct virtual audits in hours, analyze loss runs automatically, and provide value-added safety tools.